Payroll compliance remains a critical concern for employers in the UAE, as any misstep in salary deductions can lead to fines, legal issues, and reputational risk. While employers can deduct up to 50% of your employee’s salary in the UAE, it is only under specific legal conditions.

UAE labor laws set clear rules to ensure salary deductions are fair, justified, and within legal limits. Whether it’s fines, loan repayments, or social security contributions, each deduction has unique conditions; some require employee consent, while others have strict caps.

For employers, compliance with these regulations isn’t optional. Overstepping legal limits or missing key requirements can lead to penalties and disputes, making it essential to follow the right processes.

With that in focus, this guide breaks down:

Legal considerations in the UAE payroll

Reasons for salary deductions in the UAE

HR best practices for better payroll management and more.

Let’s get into the details to stay on the right side of the law.

Payroll in the UAE: Important Legal Considerations

Before looking at salary deductions, it’s essential to understand the broader payroll regulations that ensure fair and legal practices. From labor laws to the Wage Protection System (WPS), these rules help employers stay compliant and protect employees' rights.

Here’s a sneak peek.

UAE labor law

This foundational legislation sets the rights and obligations of both employers and employees in the UAE. Regarding salary deductions, it specifies:

Permissible deductions: Employers can deduct wages for reasons such as advances, pension schemes, or penalties for misconduct, provided these are clearly defined and agreed upon.

Deduction limits: As mentioned earlier, the total amount deducted cannot exceed 50% of the employee's monthly wage.

Ministry of Human Resources and Emiratisation (MoHRE):

The Ministry of Human Resources and Emiratisation (MoHRE) is the government authority that enforces the UAE Labor Law and issues additional guidelines to regulate employment practices. These guidelines ensure salary deductions follow proper documentation, employee consent rules, and transparency requirements.

Wage Protection System (WPS)

The Wages Protection System (WPS) is an electronic system introduced by the UAE Government to ensure the timely and full payment of salaries, including any deductions, in compliance with UAE labor laws.

MoHRE manages the WPS, which the UAE Central Bank regulates. The system promotes transparency and ensures employers carry out salary deductions.

How WPS works for salary deductions:

Employers must register their employees with the WPS and process salary payments through banks or financial institutions that are part of the system.

When salary deductions are applied, they must be clearly documented and reported within the monthly wage file submitted by the employer.

Employers who fail to process salaries through the WPS on time may incur fines ranging from AED 1,000 to AED 20,000 per employee, depending on the severity of the violation. Repeated non-compliance can lead to higher penalties.

Companies that fail to adhere to WPS requirements may face restrictions on issuing new work permits, limiting their ability to hire and expand their workforce. Employers who fail to comply with salary payment regulations may also face legal action from employees, including lawsuits for unpaid wages.

Some categories of workers are not subject to the Wage Protection System (WPS) requirements. These include:

Employees who have filed a wage-related complaint with the judiciary

Employees on unpaid leave, provided they can show proof of the leave

Newly hired employees within their first 30 days of wage entitlement

Employees with an absconding report filed against them

Public taxis owned by private individuals

Fishing boats owned by private individuals

Places of worship

Banks and other financial institutions

This exemption structure provides flexibility in specific cases while ensuring overall compliance with labor laws.

Mandatory & Permissible Salary Deductions in the UAE

Employers in the UAE have the authority to deduct an employee's salary under certain conditions outlined by the UAE government. These laws establish a framework that balances employee rights and employers' ability to manage their labor force.

Mandatory deductions

Retirement and insurance contributions: These deductions are mandatory to cover employee contributions toward retirement pensions, benefits, or insurance following UAE regulations.

Provident fund contributions and loans: If the MoHRE approves them, deductions for employees' contributions to the company’s provident fund or related loans are mandatory.

Court-ordered debt repayment: If an employee has debts resulting from a judicial decision, the employer may deduct up to 25% of the employee’s salary to repay the debt. However, alimony debt can exceed this limit. When multiple debts exist, the employer will distribute the deductions based on their priority.

Permissible deductions

Loan repayment with employee agreement: Employers can deduct loan repayments from an employee’s salary only with the employee's written consent, and these deductions cannot include interest.

Recovery of overpaid wages: Employers may recover excess payments made to an employee, but these deductions cannot exceed 20% of the employee’s salary.

Participation in social initiatives: Employers can make premium deductions related to social initiatives or additional benefits, but only if the employee has agreed in writing to participate.

Penalties for employee violations: Deductions for employee violations, as per the approved penalty list, are allowed, but these cannot exceed 5% of the employee’s salary.

Compensation for damages: Employers can deduct amounts to repair damages caused by an employee’s fault, but the deduction must not exceed five days’ monthly salary. Any higher amount requires court approval.

In case of multiple deductions from an employee’s salary, the total deductions cannot exceed 50% of the employee’s remuneration.

Additional employer deductions

Disciplinary penalties: Employers can penalize employees who violate labor laws. These penalties can range from written warnings to suspension or dismissal while ensuring the worker's end-of-service gratuity remains intact.

Temporary suspension from work: Employers have the right to suspend employees temporarily for disciplinary investigations lasting no more than 30 days. During this period, the employer suspends half of the employee's salary, but if the investigation concludes in the employee’s favor, the employer will pay the suspended amount.

Rules for imposing disciplinary penalties: Employers may only impose a disciplinary penalty for actions directly related to the employee’s work. Also, the employer can impose only one penalty for each violation.

Wage protection system requirement: To comply with WPS regulations, employers must pay at least 80% of the total wages to employees. If legal deductions are applied, an employee is still considered a wage recipient when receiving at least 80% of their registered salary.

What happens when an Employer Deducts an Employee’s Salary Without Consent?

Employees who face unpaid wages or salary-related issues can report them to MoHRE or use the "My Salary" service. The ministry emphasizes the need for compliance with labor laws to avoid legal consequences.

There are also discussions on forums like Reddit about employees facing salary deductions without prior consent.

HR Best Practices for Managing Salary Deductions Legally

Given the importance of salary deductions and their differing threshold limits, it's important that you follow the below-mentioned best practices to avoid costly mishaps.

Transparent policies and employment terms

✅ Have a transparent employment contract: A clear and detailed employment contract must outline the specific conditions under which salary deductions will happen. This transparency ensures that both the employer and employee are on the same page regarding deduction policies, including those for loans, penalties, or other reasons.

✅ Develop clear policies: It is important to have well-defined policies regarding salary deductions, such as pay dates and permissible deductions. These policies should be communicated clearly to all employees to avoid misunderstandings and ensure compliance with UAE labor laws.

Legal awareness and compliance

✅ Stay updated on UAE payroll laws and regulations: UAE payroll laws may change, and staying updated is crucial for ensuring that you make salary deductions legally. Reviewing the latest labor regulations helps employers avoid fines or penalties for incorrect deductions.

Visit the official UAE government website to stay informed about the latest employee salary deductions and fines updates.

✅ Conduct regular internal audits: Regular internal audits of salary deduction practices are necessary to identify and correct any errors or discrepancies in the payroll process. This proactive approach ensures that deductions are accurate and in line with legal requirements, preventing potential issues down the road.

Tech-driven payroll precision

✅ Implement a robust payroll automation system: Invest in a robust payroll automation system to manage salary deductions efficiently and accurately. With automation, you can easily handle complex calculations, ensure compliance with UAE regulations, and reduce the risk of human error.

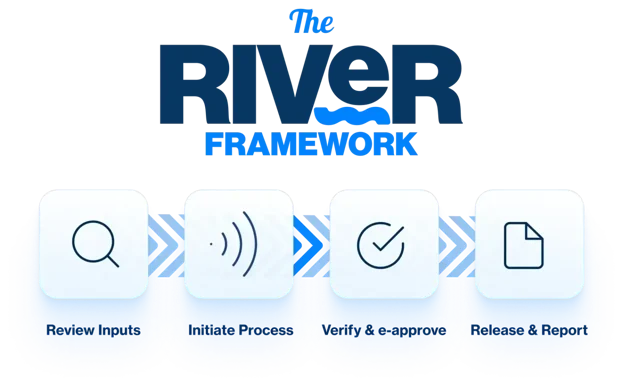

With its comprehensive payroll automation system, Darwinbox streamlines the entire payroll process. This includes an efficient four-step process based on the RIVeR framework with:

☑ Reviewing inputs: Darwinbox’s unified HCM system automatically reviews payroll inputs around the clock. It provides a live, 24/7 snapshot of key data, including employee headcount, total FTE hours, loss of pay, and benefits, keeping you in control of payroll accuracy at every step.

☑ Initiating the payroll process: With the RIVeR framework, payroll management is simplified. A single click lets you handle multiple employee types, locations, and pay cycles on the same platform. Whether it’s a small business aiming for consistency or a large organization with huge pay schedules, Darwinbox ensures payroll runs smoothly every time.

☑ Verifying and e-approving: Traditional payroll systems rely on endless Outlook emails and offline verifications. Darwinbox changes the game by digitizing the entire approval process. HR, finance, and payroll teams can collaborate on one platform, cutting down on manual back-and-forth. With customizable checklists and automated workflows, approvals move faster, and built-in chat tools promote real-time collaboration.

☑ Releasing and reporting: The final stage of the RIVeR framework handles both reporting and payslip distribution with just one click. Plus, detailed cost dashboards give businesses deeper insights, allowing them to track payroll expenses by department, employee type, or location.

What Makes Darwinbox’s UAE Payroll Compliance Stand Out?

There are several features that give Darwinbox’s payroll compliance an edge over others:

Unified payroll & compliance for the GCC

Darwinbox centralizes payroll and compliance across 6 GCC countries (UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman) on one cloud-based platform.

Key benefits:

Ensures digital, accurate, and audit-ready payroll processing.

Provides real-time sync of leaves, GPSSA/GOSI, expat benefits, transfers, and core HR data.

Ensures compliance with GOSI (KSA, Bahrain), GPSSA (UAE), and WPS regulations.

Enables easy management of country-specific benefits like EOSB, home travel airfare, housing, and transport allowances.

Audit readiness & compliance management

Darwinbox strengthens payroll compliance and simplifies audits with enhanced tracking and reporting tools.

Key features include:

Tracking every action taken by payroll stakeholders.

The payroll system directly documents approvals.

Detects and resolves payroll discrepancies early.

Access 20+ statutory and standard reports to meet compliance needs.

Download reports in bulk for faster audits.

GCC SMEs offer insights to keep businesses updated on regulatory changes.

Flexible & streamlined payroll processing

Admins can run payroll faster and with greater accuracy due to the platform’s automation and customizable options.

Darwinbox helps you:

Process payroll by department, function, or business unit.

Manage bi-monthly, weekly, and off-cycle arrears, as well as reimbursements.

Automatically updates attendance, payments, and deductions after payroll cut-off dates.

Make post-verification changes without restarting the entire process.

Customize payroll checklists, e-verify inputs, and manage approvals online.

Enhanced payroll experience for admins & employees

Darwinbox makes payroll easy and accessible for both admins and employees.

For admins:

Handle payroll approvals on mobile.

Digitally verify payroll inputs.

Streamline queries with Darwinbox’s AI-powered chatbot.

For employees:

Easily access CTC breakdowns, salary history, and payslips.

Request home air travel benefits, loans, and salary advances directly on the mobile app.

Payroll cost control & analytics

Darwinbox supports businesses to track and optimize payroll costs with advanced analytics.

Key benefits:

Analyzes payroll costs by hierarchy, cost center, and category.

Tracks actual payroll costs against budgeted amounts.

Identifies seasonal fluctuations in payroll expenses.

Provides insights on salary differences by department, division, or business unit.

Unlike focusing only on basic automation, Darwinbox provides real-time compliance updates, localized payroll accuracy, and end-to-end audit readiness, all while simplifying payroll management for both employers and employees.

Simplify Salary Deductions in the UAE with Darwinbox

Managing salary deductions in the UAE can be complex. With multiple regulations and different deduction types to follow, manual processing can lead to errors, compliance risks, and payroll delays.

Darwinbox automates salary deductions, ensuring 100% precise calculations and compliance with UAE labor laws. The platform simplifies everything from loan repayments to government contributions while providing real-time payroll insights. This enables your HR team to operate more efficiently and focus on other core initiatives.

Schedule a demo today and see how Darwinbox can streamline your complete payroll process.

FAQs

Can you take a casual leave during the probation period?

In the UAE, employers can deduct an employee’s salary under several circumstances, including the following:

Loan repayments (with employee consent)

Recovery of overpaid salary

Retirement contributions

Insurance premiums

Provident fund contributions

Penalties for employee violations (within legal limits)

Judicial debt repayments (subject to limits)

Damage compensation (for employee-caused damages)

Social project participation (with written employee consent).

How salary is calculated in UAE?

A UAE salary has multiple elements, such as basic salary, allowances (like housing, transportation, and education), bonuses, commissions, and benefits outlined in the employment contract. Ensuring clear calculations is important, as each component may have different rules and tax implications.

Is it legal to decrease salary in the UAE?

The MOHRE Resolution permits both the employer and employee to agree on a temporary salary reduction. However, both parties must obtain additional approval from the MOHRE for a permanent reduction. It’s important to outline the salary deduction information in a supplementary agreement and submit it to the MOHRE for validity.

What is the payroll process in the UAE?

The UAE WPS is an electronic system that enables private-sector institutions and organizations to pay employees through banks, exchange bureaus, and financial institutions approved by the UAE Central Bank. It aims to ensure the timely and full payment of wages to employees.

What is the payroll tax in the UAE?

Employees of Gulf Cooperation Council (GCC) countries, including the UAE, are subject to a social security rate of 20%. UAE nationals contribute 5%, which is automatically deducted from their salary, while the employer contributes 12.5%, and the government contributes 2.5%. In Abu Dhabi, a higher total rate of 26% applies.

Can coming late be subject to disciplinary action in the UAE?

Yes, coming late can be part of disciplinary action in the UAE. Employers may impose penalties for lateness if it violates company policies, as long as the action is reasonable and aligned with the terms outlined in the employment contract.

However, before imposing any penalty, the employer must follow a disciplinary procedure, which includes notifying the employee of the violation, allowing them to defend themselves, and investigating their defense by UAE Labour Law regulations.

What is the basic salary rule in UAE?

UAE Labour Law does not set a minimum salary but generally requires that wages be sufficient to meet employees' basic needs.