India’s Banking and Financial Services sector supports the fast-growing economy of a country that is in the midst of a digital revolution. Read on to learn about the current state, growth prospects, and recent noteworthy developments within this sector:

1. Great Traction with Continued Scope for Growth

Today, India is one of the most active economies in the world, supported by a strong banking and insurance sector. The relaxation of foreign investment rules has led to an upswing in the insurance sector, with many companies revealing their plans to increase stakes in joint ventures with Indian companies.

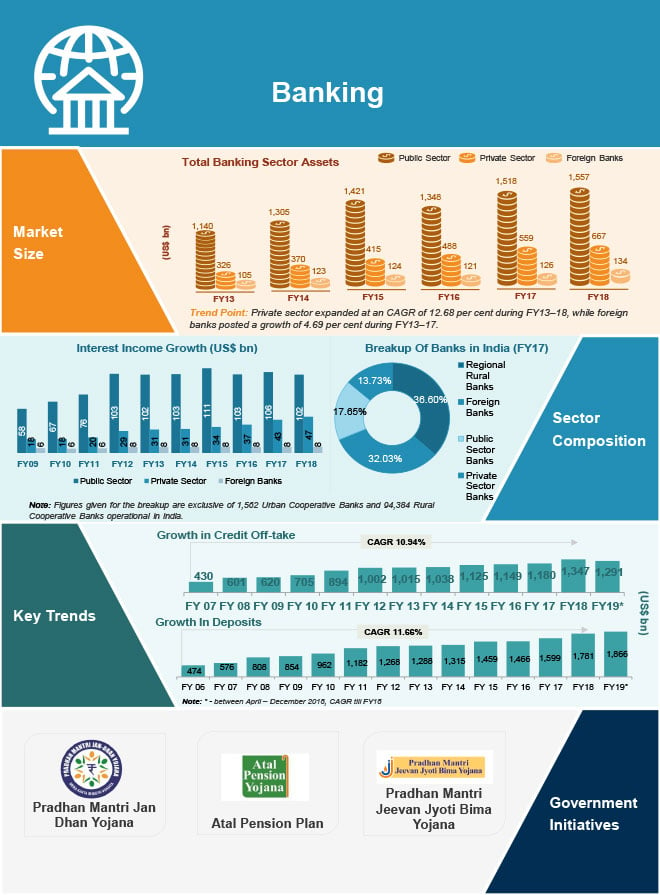

Some Key Trends:

- Growing GDP and Disposable Income

- Rise in new product offerings

- Increase in private sector contribution to 50% in 15 years

Furthermore, mobile and internet banking services have come to the forefront with multiple advancements in technology. The banking sector is focusing on providing better customer experience and also enhancing its technology infrastructure to stay competitive. India’s digital lending was at US $75 billion in FY 2018 and is expected to reach US $1 trillion by FY 2023, spurred along by the five-fold increase in the digital disbursements.

>>>Download the Full Report<<<

Source: IBEF

2. Regulatory Regime in the Right Direction

Financial policies and regulations today have become more well-defined than ever before, helping enterprises defend against perceived data threats. Clear guidelines on safeguarding technology, data privacy and security have ensured BFSI enterprises remain compliant and ready to brace any imminent threat.

Data privacy and security in the BFSI sector: With the introduction of the Insolvency and Bankruptcy Code, 2016 and the creation of Information Utilities (IU), data security and privacy have been a prime focus of attention.

Additionally, RBI's IT subsidiary for monitoring internet-based financial services indicate strong preparedness of the sector in terms of cybersecurity.

>>>Download the Full Report<<<

3. Disruption Led by Fintech

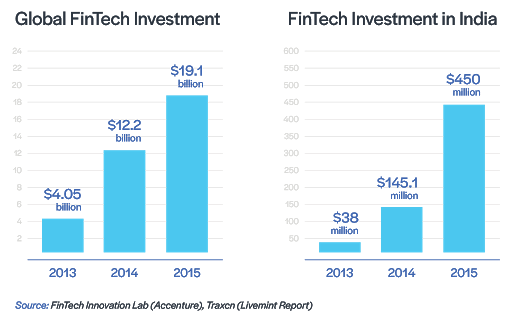

Today, investments in the Indian FinTech market are the second largest in the world, closely following China. With payments progressing from cash to digital, the financial sector is growing at an extraordinary rate and is further being helped along by technologies such as the unified payments interface (UPI). Currently, 400 FinTech companies exist in India, and their investments are predicted to grow by 170% by 2020. Experts predict that in the next five years, FinTech will go on to disrupt the entire banking sector!

The BFSI sector is evolving at a rapid pace, and the rules of the game are getting rewritten just as fast. At this rate of change, keeping the implications for HR and talent in mind, there is a burning need for solutions that we can create to aid in the sector’s growth.

Talent Solutions To Rally People Together

In the context of HR, the BFSI sector, especially the funding side, always goes through an extraordinarily difficult time for various reasons. While there is always systemic risk hindering a smooth process flow, investments in entrepreneurial ideas not giving the desired returns have made the journey challenging. In the face of these crises, one cannot view any regulatory setup as a constraint or as an enabler. A disciplined business model can still be developed using the existing regulatory regime. And however strong the regulations are, a company can still suffer major problems.

“At the end of the day, solutions must happen from within the company, starting from within one’s own department.”– Dr. Nandagopal, Founder & CEO, Insurance Inbox, Ex-CEO, Indiafirst Life Insurance

Ultimately, only people can rally together behind a crisis, create solutions and bring about change. If people are properly trained, motivated and know what they are doing, there shall never be any kind of accidents. When the head of Prudential, one of the largest insurance companies in the world was retiring, people asked him just one question. “What is it that you have done well in your life?”

He said, “I just took care of my people”.

Insurance Sector – Different Models Of Hiring Talent:

Different insurance organisations have different models of hiring talent. In one of my previous organisations, the motto was to hire more and more people to open branches and sell policies. Although this model led to the organization creating the biggest record in the industry of selling two million policies in their first year, it soon became stagnant and they ran into problems. In all this, India First Life Insurance turned things around when they recruited only a handful of people to manage a large group of branches.

>>>Download the Full Report<<<

3-Point HR Mantra:

The kind of HR practice to follow is first, don’t entirely rely on hiring people with vast experience and domain knowledge. They will be set in their conventional ways and will be unable to recognize the requirements of the new age. Secondly, hire people who only care about the job and are going to be committed, motivated employees in the long run. Thirdly, try to hire people on the basis of performance-based variable pay. Incentivising on that principle can bring people who will be genuine assets in the future. They may not be recruited in the traditional way but organisations have to devise innovative approaches to achieve the same. If they can be found and mentored with patience, they will eventually deliver the expected results.

Retail Banking Vs NBFCs- Solving the Asset-Liability Mismatch

There are two negative trends happening in BFSI. One is the conventional big banks withdrawing from retail banking, leaving it to NBFCs. People at retail banks have the opportunity and access to raise funds, but NBFCs do not have that. This causes an asset-liability mismatch. Two, NBFCs might try to raise funds through CPs, short-term loans, mutual funds, etc. but when it comes to long-term loans, five years minimum corporate loans, home loans, etc, they can suffer if the going gets bad. This causes fluctuations in the financial services sector, which impacts the automobile sector and other sectors in a chain reaction. NBFCs have to be treated on par with banks. Most of the retail funding is happening in the underprivileged sector, either through MFIs or through NBFCs. There are eleven thousand plus NBFCs today, and sixteen percent or twenty percent of the money being funded through them. They need to have the same access as banks in order to make use of the opportunity to raise more money. However, extensive debate and support from both the Government and the RBI will be needed for this change to happen.

In addition, India has a huge market for Fintech startups which is mostly untapped. Of this, 40 percent of the population do not have bank accounts, and 87 percent of payments are made in cash. With the penetration of mobile phones expected to rise from the current 65-75 percent to a whopping 85-90 percent by 2020, and the penetration of internet readily climbing, the growth potential for FinTech in India is vast.

>>>Download the Full Report<<<

4. Technology Redefining Process Semantics

The extent of evolution in technology, regulation and customer behavior, along with the emergence of new competitors, means that the future of BFSI will be nothing like the past. Technology is not only enhancing customer experience, but also helping organisations become more agile and efficient in policy approvals and dispersals. Concepts of the past like digital branch enablement, remote field force are now a reality. Over the next three to five years, digital efforts will advance in areas as diverse as robo-investing, automation of consumer lending and clearing and settlement of cash and securities transactions. With the advent of the millennial generation, there is also a real demand for mass customisation of products vs just providing off-the-shelf solutions. According to a PWC report, advances in processing capacity, customer profiling, and risk analytics are now opening the way for a new generation of ‘smart’ policies. These are as affordable and easy to understand as compared to today’s off-the-shelf products. These policies could be both fully customised to individuals and also adaptable to their changing needs. Crucially, the technological developments that are making this new generation of policies possible would also make it easier for new entrants to break into the market at relatively little cost.

For more such insights from CHRO’s of leading organisations like Bajaj Finserv, SBI Life, Reliance Capital, Tata Capital, Kotak Life & General, Karvy, Bharti Axa Life & General, etc. download the complete docket of the second edition of Darwinbox’s ‘CHRO Dialogue’ on ‘Excellence in BFSI through Talent and Technology’, click here.

Speak Your Mind